tax lawyer vs cpa reddit

Basically I made quite a bit of money in the stock market and as the typical stock market gains story goes I also lost a lot of what I gained. Accounting firms also seem to be way more technicalinvolved in thought leadership which was more appealing to me.

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

This makes the planning process easier for my clients who know that I have all their bases covered.

. With a tax attorney you enjoy the protection of attorney-client privilege. The biggest difference in terms of tax practice is that an attorney is often going to be much better at appearing in tax court and framing an argument. In terms of straight cash a law degree will serve you better.

Honestly they are very very similar at the higher levels. Of course there are competitive attorneys out there and there can be exceptions to this rule. Klasing with your tax strategy needs you gain the benefit of an experienced international tax lawyer and a seasoned CPA for the price of one.

When you entrust the Tax Law Offices of David W. A tax attorney is a type of lawyer who specializes in tax law. Am I better off with a CPA or paying extra for a tax attorney.

Even with the loans. Tax attorneys provide attorney-client privilege. While both CPAs and tax attorneys can represent your best interests in communications with the IRS a tax attorney is generally the better choice if youre involved in trouble with tax authorities such as owing thousands in back taxes or facing liens and levies.

There is heavier accounting work at the Big 4 even if youre mainly in a transactions or advisory capacity and heavier strictly legal work at law firms as youd expect - ie you might be called to review a compliance project at the Big 4 and draft ie the tax risk clauses in a. You can share such secrets with your tax attorney and rest assured the information will be kept. Just doing quick math I am going to owe quite a bit more than what I am capable of paying right now.

Honestly tax lawyer is an entirely different path from a cpa. A cpa at the big 4 will start out in the mid-50k range and maybe be at 100k after 5 years in a big metro. Hes kind of living the life right now.

However tax attorneys are educated to handle legal challenges and can represent clients in the court system whether the clients are bringing a case against the IRS or the IRS is investigating. Thats a long 5 years filled with busy seasons and lots of. If you have top 10 law school credential you have better educational credentials than maybe 90 of people in big 4.

You will pretty much be considered for tax or regulatory compliance groups and only if you had some experience in those areas. A tax attorney tends to offer a short yet intensive legal service. After working at different accounting firms I found that I liked working with high net worth individuals because my research and writing abilities.

As a general rule tax lawyers engage accountants CPA or EA for preparation of tax returns for their clients. For example if youre hiding money in an offshore account. Tax lawyers hourly rates are too high to justify that.

By BigAristotle Sun Aug 10 2008 559 am. 3y Audit Assurance. The ceiling for cpa is much lower and compensation reflects that.

Students in tax at the graduate level going for an mtax are often sitting side by side. Choose a tax lawyer when receiving notices of debt. One of my interviewers for a investment firm graduated as an accounting major at my school did audit 2 years went to law school and landed a job at his current gig as a tax attorney.

My attorneys firm charges 450hour for attorneys and 210hour for paralegal work and they want a 3250 down payment. With the exception of a few major areas in tax MA PE International Litigation etc most of the big law firms dont even bother. Tax return preparation is a time consuming process - especially when tax situation is complex and may require multiple drafts to achieve the optimal result.

As such theyre more liable to charge more for brief periods. So I looked into doing international tax state and local tax etc. Secondly while attorneys may have taken courses on tax or estate law this.

It is title 26 of united states code. Hire a tax attorney if youre one of the unlucky 25 getting audited this year or if youre dealing with any other tax controversies. Both offer strong job security.

In the tax area the lines between accountants and attorneys can be blurred. Unfortunately your law degree will limit your options in accounting firms even if you have a CPA. You dont have that legal shield with a CPA.

Prior to becoming a tax attorney Mr. A tax attorney is the best fit for negotiating tax settlements audits and other complex issues with the IRS. Unlike other tax relief companies who only have Enrolled Agents CPAs or tax attorneys TRP has all three working on the right parts of your case.

This results in outstanding results and an affordable cost. If your business faces legal tax issues you need to hire a tax attorney because they have a deeper understanding of the legalities in the US. This is understandable according to James Mahon a shareholder in the Tax and Litigation practice groups of law firm Becker Poliakoff.

But the CPA may offer more flexibility because you can do accounting firm jobs or head up an in house department to other corporate type positions. After law school and obtaining my CPA license I knew I wanted to begin working in an area of law that had an emphasis on tax. Klasing worked for nine years as an auditor in public accounting.

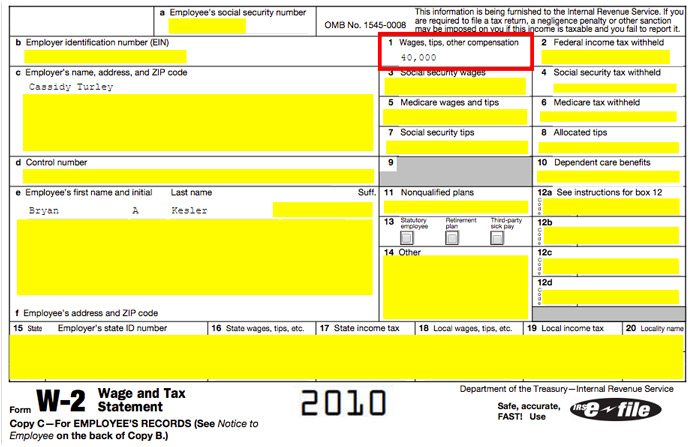

Fees for Estate Tax Return 706. CPA vs Lawyer How much do CPAs and lawyers typically charge to prepare estate tax returns form 706 for a relatively simple estate. A CPA-attorney when asked what he does for a living replies that he practices tax.

With all the related interpretations and cases. As an accountant you may prepare taxes and do bookkeeping although a CPA license allows you to represent a tax client before the IRS and sign off on audits carrying higher prestige and salaries. By being both a CPA and lawyer my ability to understand the numbers as well as the legalities associated with estate planning help me bridge that gap and avoid conflict.

You may work in the accounting field without a CPA license which is different from the legal profession which requires a legal license for most areas of practice. By comparison a CPA or EA is a more long-term solution and you should thus pay less for their services upfront. While a tax attorney is typically reserved for more specific and complex tax issues whereas the CPA is usually utilized on a more regular basis to keep your financial records in order and prepare your taxes the advantages of having a two-in-one professional are hard to overstate.

A tax attorney who plans during college can easily become a CPA as well. The Roles of an International Tax Attorney. I suppose the benefit of being a CPA and not attorney is that you graduate sooner and dont spend all that money on tuition.

Anything you tell your CPA could be divulged to the IRS or in court.

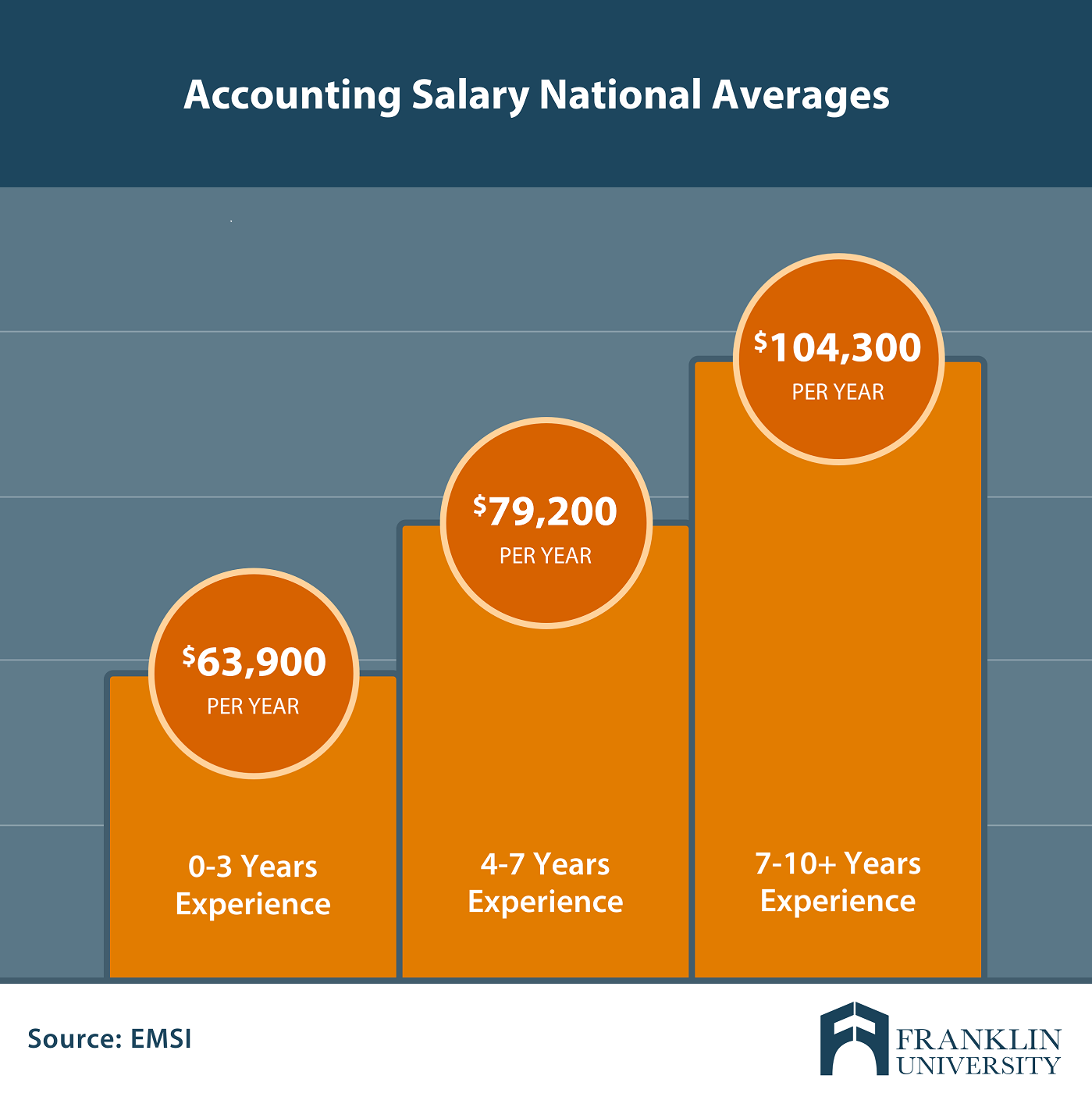

Master S Degree In Accounting Salary What Can You Expect

Hiring A Tax Professional Your Complete Guide Optima Tax Relief

Top Rated Tax Resolution Firm Tax Help Polston Tax

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

The Cpa In Public Accounting Starter Pack R Starterpacks

Post Moass An In Depth Examination Of Financial Advisors Tax Attorneys Certified Public Accountants Wills R Superstonk

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Top Rated Tax Resolution Firm Tax Help Polston Tax

I Had To Do It Accounting Humor Accounting Finance Infographic

Fee Structure Tax Preparation Fees Wcg Cpas

Top 10 Cpas In Cheyenne Wy Peterson Acquisitions

Advice For Tax Accountants How To Accept Praise

Is The Cpa Exam Worth It For Accountants To Pursue

The Current State Of The Job Market For Accountants From Today S Wells Fargo Conference Call R Accounting

Tax 101 Accounting Humor Law School Humor Accounting

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Iama Tax Professional Willing To Answer Any Of Your Tax Related Questions Ama R Iama