amazon flex driver tax forms

Be 21 or older. If you make under 600 then you dont need to file it for taxes and thats why your not seeing the 1099 form.

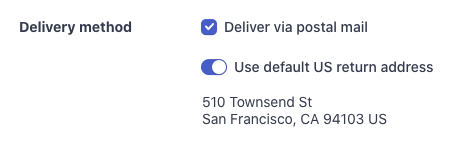

Deliver Your 1099 Tax Forms Stripe Documentation

Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment.

. The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after. Click ViewEdit and then click Find Forms. With Amazon Flex you work only when you want to.

This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program. 1099 NEC Tax Forms 2021and 25 Self-Seal Envelopes 25 4 Part Laser Tax Forms Kit Pack of FederalState Copys 1096s Great for QuickBooks and Accounting Software 2021 1099-NEC 25 Pack. Knowing your tax write offs can be a good way to keep that income in your pocket.

Actual earnings will depend on your location any tips you receive how long it takes you to complete your deliveries and other factors. Amazon Flex is a self-employed delivery driver opportunity where you can use your own car SUV minivan or cargo van to deliver packages to Amazon customers using the Amazon Flex app. To be eligible you must.

If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am. You pay 153 SE tax on 9235 of your Net Profit greater than 400. Most drivers earn 18-25 an hour.

Or download the Amazon Flex app. Have a mid-size or larger vehicle. Actual earnings will depend on your location any tips you receive how long it takes you.

Get started now to reserve blocks in advance or pick them daily based on your schedule. No matter what your goal is Amazon Flex helps you get there. Ad We know how valuable your time is.

Maybe you have a few hours spare on a weekend or are looking to turn your people mover into a money maker. 12 tax write offs for Amazon Flex drivers. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone.

Driving for Amazon flex can be a good way to earn supplemental income. With the Bonsai. Gig Economy Masters Course.

Sign in using the email and password associated with your account. A 1099 form is a series of documents the IRS calls an information return defined as a tax return that contains taxpayers identifying information but does not state their tax liability. Op 2 yr.

1099 Forms Youll Receive As An Amazon Flex Driver. Get it as soon as Fri Feb 4. Select Sign in with Amazon.

Op 4y Virginia Beach Logistics. Let Bonsai Tax Handle Your Amazon Flex 1099 Forms And All Other Self-Employed Taxes. If youre looking for a place to discuss DSP topics head over to ramazondspdrivers.

Click Download to download copies of the desired forms. Whatever your goal is Amazon Flex can help you get there. This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program.

Have a valid US. Amazon Flex drivers deliver goods and groceries ordered through programs like Prime Now and AmazonFresh which allow customers to leave tips for their drivers. Increase Your Earnings.

The agency urged affected Amazon Flex drivers to deposit or cash their checks before Jan. Tap Forgot password and follow the instructions to receive assistance. 7 2022 and said that drivers who receive more than 600 will receive federal tax forms to report the.

If youre looking for a place to discuss DSP topics head over to r. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. We would like to show you a description here but the site wont allow us.

Amazon Flex Taxes Documents Checklists Essentials

Anyone Else Getting This Exactly 5000 00 Pay For 2019 I Have Trouble Believing That My Random Blocks And Whole Foods Flex Delivery Work Paid Me Exactly 5000 00 R Amazonflexdrivers

What To Do With Your Amazon 1099 K Amazon Done With You Selling Online

Fillable Form 8822 B Change Of Address For Business Change Of Address Form Internal Revenue Service

Are Legal Settlements Taxable What You Need To Know

How Couriers File Their Taxes All Your Food Delivery Tax Questions Answered Courier Hacker

What Are Income Limits That Will Allow You To Qualify For Medi Cal Or Coveredca Health Plans Income Health Plan How To Plan

![]()

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tax Deductions Mileage Tracking App

2021 Daily Income Mileage Toll And Taxes Tracker For Etsy In 2022 Daily Expense Tracker Rideshare Income

Deliver Your 1099 Tax Forms Stripe Documentation

Is Buying A Car Tax Deductible In 2022

Doordash Taxes Does Doordash Take Out Taxes How They Work

2015 2021 Form Irs 8822 Fill Online Printable Fillable Blank Pdffiller Money Template Change Of Address Irs

Filing A W 2 And 1099 Together A Guide For Multi Income Workers

How To Get Uber Tax 1099 Forms Youtube

Common Tools Can Save You Time Money On Taxes Nerdwallet Electronic Filing System Tracking Mileage Save Yourself